Apparently, economists are now discovering that getting more money doesn’t always make you poorer.

Who woulda thought it!

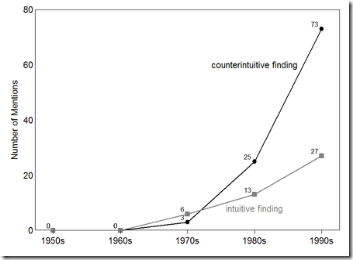

What we seem to have experienced over the past few years is a massive smart-arsed-economist Freakonomics-syle “counterintuitive finding”-obsession FAIL.

Yes, free money accruing to governments (resources or aid) probably doesn’t do much for their accountability, but does this governance effect really outweigh the free-money effect? Are the institutional effects of free-money so damaging that free money makes countries poorer? Or are we just trying too hard to be clever and “counterintuitive.”?

(As a final aside – the resource/aid/free-money curse only exist when the money is flowing to the government. Giving oil revenues or aid directly to poor people rather than to their governments is obviously logistically more difficult, but ameliorates this problem entirely).

2 comments:

"but does this governance effect really outweigh the free-money effect?"

Does anyone argue this? The per capita GDP of Equatorial Guinea shot up after they discovered oil.... but 99% of that income is going to the president and his cronies. Not exactly a win in my book.

"Giving oil revenues or aid directly to poor people rather than to their governments is obviously logistically more difficult, but ameliorates this problem entirely)."

Why this makes theoretical sense (and I wish this was on the table more often). Is there actually any evidence of this?

Is the "oil curse" really a bit of cutsey, counter-intuitive economics? I think most people have recognised an oil curse for as long as there has been oil. It's usually less about absolute income though - name all the oil-based economies in the world and tell me the proportion of them you think are reasonably developing.

Click on the first research paper on Paul Collier's website. http://users.ox.ac.uk/~econpco/research/africa.htm

"Commodity Prices, Growth, and the Natural Resource Curse: Reconciling a Conundrum"

Then read the abstract:

Commodity booms have unconditional positive short-term effects on output, but non-agricultural booms in countries with poor governance have adverse long-term effects **which dominate the short-run gains.**

That looks to me like an argument that the governance effect can outweigh the free money effect.

Post a Comment